The Rise and Rise of South Korea’s Arms Exports

KF-21 Boramae fighter

South Korea’s defense exports more than doubled from $7 billion in 2021 to over $15 billion in 2022 so far, in a sign of the growing international popularity of its military equipment.

While the export figures may be a fraction that of other arms exporting countries such as the U.S., Russia and the U.K., its key exports including fighter jets, artillery guns, tanks, warships and trainer aircraft have competed and won against the best of Western and Russian arms.

In August 2022, South Korea agreed to sell nearly 1,000 K2 main battle tanks (MBTs), 648 K9 self-propelled howitzers (SPHs) and 48 FA-50 fighter jets to Poland for an estimated $15 billion. The Polish Armaments Agency (AA) announced on August 26 that a $3.4 billion execution contract was signed with Hyundai Rotem for the delivery of 180 K2 MBTs in 2022–25 and a $2.4 billion contract with Hanwha Defense for the delivery of 212 K9A1 SPHs in 2022–26.

As per a March 2022 Stockholm International Peace Research Institute (SIPRI) report, South Korea was the eighth largest arms exporter in 2017–21 with a 2.8% share of the global total. Its arms exports were 177% higher than in 2012–16. Asia and Oceania accounted for 63% of South Korean arms exports in 2017–21 and Europe for 24%.

Seoul further developed its arms export relations in other regions, especially the Middle East. In 2021, for example, Egypt selected artillery systems and the UAE selected air defense systems from South Korea for major military procurement projects.

From 2016-20, South Korea’s global share of major arm exports was 4.3%.

“This rapid growth has mainly been the result of improvements in the South Korean arms industry’s ability to produce advanced major arms that can compete with those produced in more established arms-supplying countries,” the SIPRI report says.

Major defense exports

K9 Thunder Gun-Howitzer

The K9 Thunder 155mm / 52 caliber SPH is among the most popular howitzers in the world. This is due to its competitive performance and attractive price. The self-propelled artillery has been exported to Poland, India, Australia, Egypt, Norway etc.

|

Year |

Country |

Approximate value |

Notes |

|

2015 |

India |

$550 million for 100 units |

Repeat order likely of 200 K9 Vajra-Ts worth $1.2 billion. The new batch will include an enhanced engine suited for high altitude operation.

|

|

2016 |

Finland |

$160 million for 48 units |

|

|

2017 |

Norway |

$230 million for 24 units |

Norway’s K9 VIDAR differs from K9A1 configuration by including the Norwegian ODIN fire support system and radio communication systems for NATO operation. |

|

2018

2021

|

Estonia |

$50 million for 12 units

$20 million for additional 6 units |

|

|

2021 |

Finland |

$30 million for 10 units |

|

|

2021 |

Australia |

$730 million for AS9s, 15 AS10 armored ammunition resupply vehicles |

K9 Thunder is known in Australia as the AS9 |

|

2022 |

Egypt |

$1.7 billion for ~200 K9s |

Deal includes production of unspecified numbers of K9A1EGY, K10, and K11 FDCV in Egypt |

|

2022 |

Poland |

$2.4 billion for 212 units |

Potential deals that could go South Korea’s way

|

2022-23 |

K9A2 Thunder for the UK’s Mobile Fires Platform (MFP) project |

Team Thunder is participating in program starting in the late 2023 to replace Britain's AS90 with K9A2 variant |

Team: Leonardo UK, Pearson Engineering, Horstman Defence Systems, and Soucy Defense, Lockheed Martin UK |

|

2022 |

Arion-SMET Unmanned Ground Vehicle |

U.S. Army to subject Arion-SMET to Foreign Comparative Testing (FCT) |

The FCT aims to test items and technologies of U.S. foreign allies that have a high Technology Readiness Level to satisfy the Pentagon’s need. |

Hanwha is offering K9A2 for UK’s Mobile Fires Platform (MFP) program. The stand-out feature of K9A2 is a fully automatic ammunition handling system to increase the rate of fire to 10 rounds per minute. Besides, the proposed British version of the K9A2 will be equipped with new composite rubber tracks.

K2 Main Battle Tank

Designed by the South Korean Agency for Defense Development (ADD) and manufactured by Hyundai Rotem, the K2 is one of the world’s most high-tech and expensive battle tanks- a single unit costs around $8.5 million. Russia’s T-14 Armata and U.S.-made M1A2 Abrams come with a price tag of $3.7 million and $4.3 million respectively.

On 27 July 2022, Polish Armaments Group (PGZ) and Hyundai Rotem signed a framework agreement to supply 180 K2s and 820 K2PLs.

KAI T-50 Aircraft

Developed by Korea Aerospace Industries (KAI) and Lockheed Martin, the T-50 Golden Eagle is a family of supersonic advanced jet trainers and light combat aircraft. T-50 has been further developed into aerobatic and combat variants, namely T-50B, TA-50, and FA-50. The aircraft has a top speed of 1,640 km/h at 9 km altitude, which makes the Golden Eagle one of the fastest trainers in the world.

A single unit of T-50 costs around $30 million. The T-50 is in the same class as trainers like American Boeing / BAE Systems T-45 Goshawk and Yakovlev Yak-130.

|

Year |

Country |

Approximate Value |

|

2011

2021 |

Indonesia |

$400 million for 16 T-50i units

$240 million for 6 units |

|

2013 |

Philippines |

$400 million for 12 FA-50s |

|

2015-17 2021 |

Thailand |

$400 million for 14 T-50THs $78 million for 2 units |

|

2019 |

Iraq |

$360 million for 24 T-50IQ |

|

2022 |

Columbia |

$600 million for 20 jets |

|

2022 |

Poland |

KF-21 Project

The KF-21 Boramae stealthy fighter is being developed by South Korea’s Korea Aerospace Industries (KAI) with Indonesia.

The air-frame is stealthier than any fourth-generation fighter, but does not carry weapons in internal bays like fifth-generation fighters, though internal bays may be introduced later in development.

To know more about KF-21 jet’s features, please click here.

Competition in the market

The KF-21 is seen as a competitor to Lockheed Martin’s F-16, Saab’s Gripen, and Chinese jets such as J-10, J-20 and FC-31.

Potential KF-21 customers

The Philippines Air Force has announced that it could consider the KF-21 even after having shortlisted the F-16 and the Gripen for its fighter acquisition program.

Indonesia as a partner in the KF-21 project, is expected to receive some 50 aircraft. Other potential buyers could be Egypt and Tunisia.

Offshore Patrol Vessels

South Korea’s Hyundai Heavy Industries (HHI) won a $573 million contract to deliver Offshore Patrol Vessels (OFVs) to the Philippine Navy in June 2022.

FFX Multipurpose Frigates

The Incheon-class frigates, also known as the Future Frigate eXperimental (FFX), are coastal defense frigates of the Republic of Korea Navy. Philippines placed an order for two new Incheon-class frigates in October 2016.

An improved version is being introduced as the FFX Batch III Ulsan-class frigates Six of which will be built in South Korea.

Several countries in South East Asia are reported to have expressed in the FFX Batch III Ulsan-class frigates as their speed, features and weaponry have few competitors in the world.

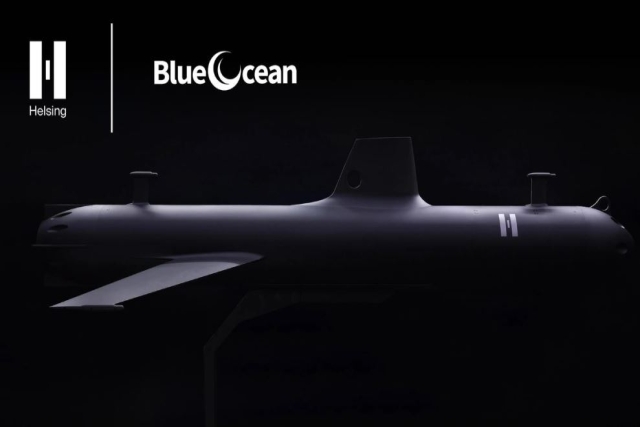

Jang Bogo-class submarines

Indonesia purchased three 1,400-ton Jang Bogo-class submarines as part of a $1.07 billion deal signed in 2011. Jakarta is also expected to ink another $900 million contract for three additional submarines.

Strong R&D is the secret to South Korea’s weapons exports

South Korea’s defense R & D push is spearheaded by the Defense Acquisition Program Administration (DAPA), Defense Technology Promotion Institute (DTPI) and the Agency for Defense Development (ADD).

In addition to using its home grown R & D to develop its own products, South Korea is positioning itself as a developer and exporter of cutting-edge solutions for the Western defense industry.

At an event in Seoul during September 2022, the U.S. Army's Combat Capability Development Command introduced major areas of interest for possible cooperation and R&D projects with South Korean firms; and the Singapore Defense Science and Technology Research Institute discussed ways to cooperate in artificial intelligence and robotics.

A memorandum of understanding (MOU) was signed between American UAV manufacturer, General Atomics and Korean companies- Huneed Technology, Wooriro and Korea Jigsaw. General Atomics plans to introduce components made by South Korean companies into all of its future UAV projects. In another cooperation project, French company, Thales plans to conduct joint research on sonar and sonobuoy with South Korean company, Sonatech.

All new R & D projects:

South Korea is seeking to create all-new defense products based on government-funded R & D. In an October 12 announcement, DAPA invited bids from local companies for an Hydrogen-powered light tactical vehicle and a 105mm self- propelled howitzer with a combined budget of 479 Billion Won (US$ 337 million approx).