Key Japanese Firms Decides Not To Attend Australian Submarine Event

Mitsubishi Heavy Industries and Kawasaki Heavy Industries have rejected an invitation to attend a gathering of top Australian naval officials and politicians this week.

The no-show by the two Japanese firms at an event called Australia’s Future Submarine Summit, held amid intensifying competition for the deal, exposes a potential weak link in Prime Minister Shinzo Abe’s more muscular security agenda.

While Abe wants Japanese firms to vie for overseas orders after he lifted a decades-old ban on arms exports last year, such companies are showing little appetite for doing business in foreign markets after being restricted to local sales for so long, Japanese defense officials and experts said.

That isolation, imposed after Japan’s defeat in World War II, has left the country’s industrial heavyweights with few contacts in foreign defense departments and made weapons a small part of their operations.

Experts say they also worry about being called “merchants of death” at home, where Japan’s wartime role remains a sensitive issue, should they start selling state-of-the-art weapons abroad.

“Winning deals overseas means having to develop contacts in foreign governments or seek joint ventures, and that is a bit much for them, so they are holding back,” said a Defense Ministry official in Tokyo.

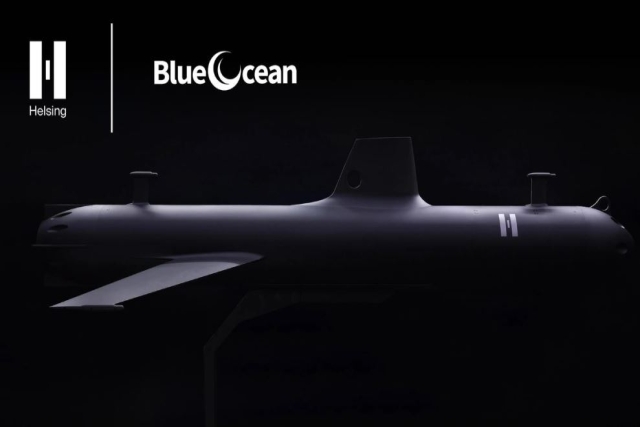

The officials involved in organizing the conference in Adelaide said Mitsubishi Heavy and Kawasaki Heavy, makers of the Soryu-class stealth submarines, had declined an invitation.

Australian Defense Minister Kevin Andrews and senior naval officials will attend the two-day event, which starts on Wednesday. A decision on the submarine project, worth 50 billion Australian dollars ($38.8 billion) over the life of the vessels, is expected by year’s end.

“We don’t plan to send anyone. The sub issue is in the hands of Japan’s Defense Ministry,” said a spokeswoman for Kawasaki Heavy. A Mitsubishi Heavy spokesman added, “We aren’t sending anybody.”

Australian Prime Minister Tony Abbott had pledged ahead of his election in 2013 that up to 12 submarines would be built at state-owned shipbuilder ASC in Adelaide, before back-pedaling by signaling that cost and timely delivery were paramount.

After Australia and Japan agreed in June to cooperate on military technology, sources said Canberra began leaning toward buying an off-the-shelf version of the 4,000-ton Soryu-class submarine to replace six ageing Collins-class vessels.

Abbott’s government ruled out an open tender in December, appearing to put Japan in the box seat.

But Abbott then came under growing pressure from labor unions and the main opposition party, which both demanded a local build to boost Australia’s languishing manufacturing industry.

Just before an internal challenge to his leadership in February, which he survived, Abbott promised something closer to an open tender in an attempt to shore up political support.

The reluctance of Mitsubishi and Kawasaki to chase Australia’s biggest defense deal — they have let the Japanese government play the lead role in talks with Canberra up to now, according to Japanese Defense Ministry officials — is in contrast to Germany’s ThyssenKrupp Marine Systems.

ThyssenKrupp, along with France’s state-controlled naval contractor DCNS, have both expressed interest in the tender and said they would build in Australia.

Delegations from ThyssenKrupp have visited Canberra in recent months. A ThyssenKrupp spokesman said the company would be represented at the conference. The event’s leading corporate sponsor is Siemens AG, which makes electrical engines and fuel cells for ThyssenKrupp’s submarines.

Abbott has also thrown open the tender, which he has called a “competitive evaluation process,” to ASC.

“The sense I’m getting from Australia is that the competitive evaluation is weighted in Japan’s favor, but it requires a proactive industrial approach,” said a defense industry official who will attend the Adelaide meeting.

“It’s Japan’s to lose unless they wake up to the opportunity,” he added. “Defense managers don’t have much influence. Risky projects aren’t going to make it past the board,” one participant told Reuters at the event.