United Technologies, Raytheon Merge To Form “Raytheon Technologies”

United Technologies Corp (UTC) and Raytheon announced a merger on Sunday, which they plan to name as “Raytheon Technologies." The combined company is forcasted to have approximately $74 billion of annual sales this year, putting it behind Boeing as the second-largest aerospace and defense company in the US by revenue.

Under the terms of the agreement, which was unanimously approved by the Boards of Directors of both companies, Raytheon shareowners will receive 2.3348 shares in the combined company for each Raytheon share.

Upon completion of the merger, UTC shareowners will own approximately 57 percent and Raytheon shareowners will own approximately 43 percent of the combined company on a fully diluted basis, Raytheon said in a statement Sunday.

Raytheon and UTC have a combined market value of close to $166 billion. The stock price of each has gained more than 21% this year, CNBC reported. According to Reuters, the new company would be worth $121 billion.

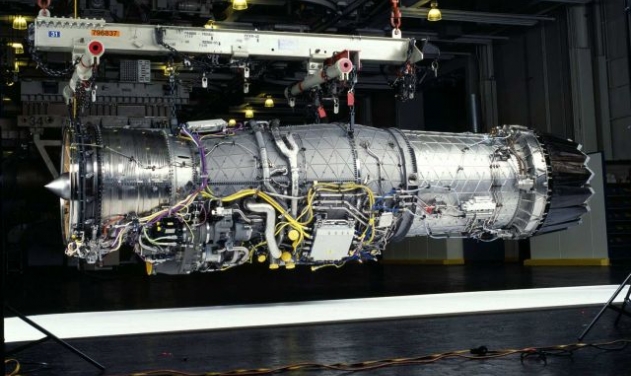

The combined company will manufacture products that range from Tomahawk missiles and radar systems to jet engines that power passenger planes and the seats that fill them.

The merger is expected to close in the first half of 2020, following completion by United Technologies of the previously announced separation of its Otis and Carrier businesses. The timing of the separation of Otis and Carrier is not expected to be affected by the proposed merger and remains on track for completion in the first half of 2020, Raytheon said.

UTC in September last year announced that will acquire Rockwell Collins for $140.00 per share, in cash and UTC stock. Following this, Boeing and Airbus raised concerns that the acquisition would raise costs and slow down production of planes.